🔔 Opening Bell

Let’s Ring the Opening Bell and Learn Something New Today. In a world of noise and nonsense, smart investors start with signal. Let’s cut through the hype because you're not here for guesses—you’re here to build.

Archer Aviation, Inc (ACHR)

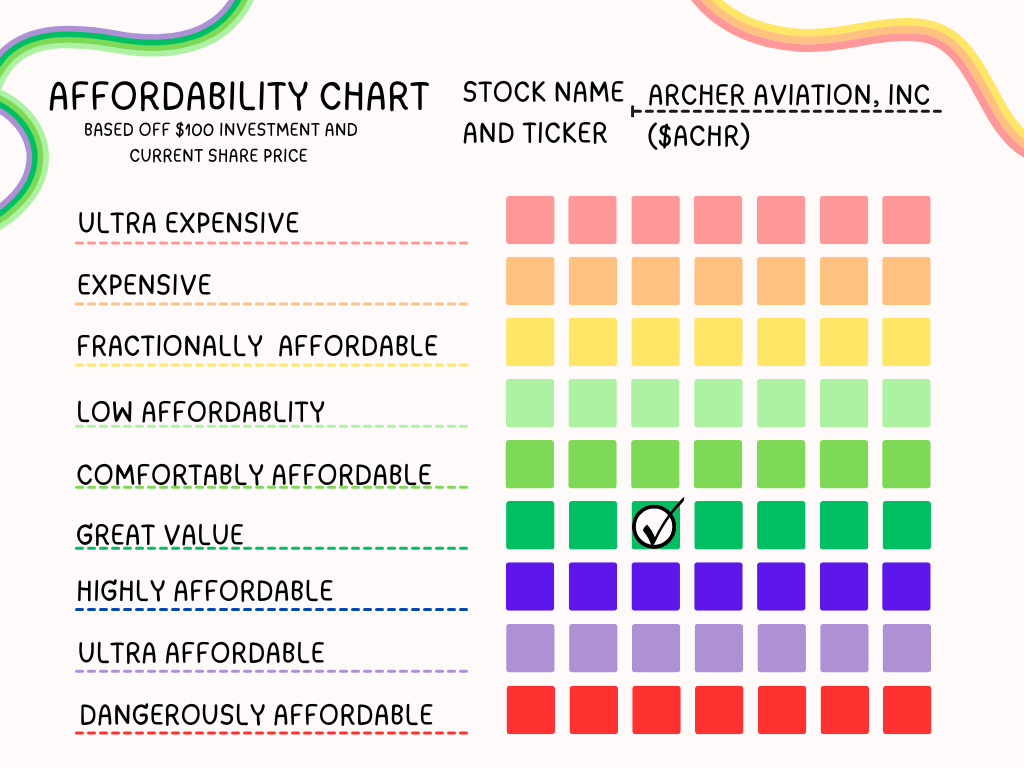

The “Vibe” $9.82 Feels Like

As a father with a family to support, $100 can either be a luxury or an investment. So I created a simple visual aid to check if a stock feels affordable. That $100 buys me about 10 shares. 10 shares of a ticket into the future of air taxis. Do they lift me off the ground right now? Not yet, but they carry the possibility of one day turning short flights into real returns. In a small way, it feels like buying a seat on the first flight before the world even sees the runway. And with their involvement in the 2028 Summer Olympics my $100 could be hitching a ride on the Olympic Torch, helping fund the aircraft that could steal the spotlight when the world will be watching.

💬 Ask & Interact

• Timeless Pick: Peter Lynch - One Up on Wall Street. Clear, practical frameworks for finding mispriced growth.

• Have a questions for a future issue? Hit Reply (because I read them all) with your ticker + focus.

🔍 Deep Dive: ACHR (Archer Aviation, Inc)

Summary:

Archer Aviation (ACHR), headquartered in San Jose, develops electric vertical takeoff and landing (eVTOL) air taxis. The “Midnight” eVTOL is a piloted, 4-passenger electric air taxi optimized for ~20-mile urban hops with ~10–12 minute fast charging between flights. The FAA issued final airworthiness criteria for Midnight in 2024, and Archer has been advancing flight testing. Archer also runs a growing defense line alongside its commercial air-taxi plans.

Getting into the Swamp:

Archer is not making big money yet. But here’s how they expect to start:

Military projects – The company is working with the U.S. military to provide special aircraft. These early deals should bring in some money before passenger flights are ready.

International launches – Archer plans to deliver some of its first aircrafts to places like the United Arab Emirates, where cities want to try electric flying taxis sooner.

Passenger flights in cities – Once the aircrafts are fully approved for safety, Archer wants to start flying paying customers in big cities like Los Angeles.

What does that mean in numbers?

In 2025, Archer might only make about $1.4 million (pretty small).

By 2026, that could grow to around $100 million.

In 2027, the number could reach almost $450 million as more aircrafts are built and more flights start happening.

Regulations & Certification — What’s Done vs Pending

✅ Already Achieved

FAA Part 145 Repair Station (Feb 2024). This certificate allows Archer to legally repair and maintain its aircraft. It proves they can handle their own fleet’s upkeep and eventually service customer aircraft.

FAA Part 135 Air Carrier & Operator (Jun 2024). This is the license airlines need to carry paying passengers. Archer can’t use it yet for air taxis until their aircrafts are approved, but having this certificate means they’ve already met the business and safety requirements to one day sell tickets.

FAA Part 141 Flight School (Feb 2025). This lets Archer run its own pilot academy. They can now train and license pilots specifically for flying their Midnight aircraft, instead of relying only on outside schools.

FAA Final Airworthiness Criteria for Midnight (May 2024). These are the official safety standards for Archer’s aircraft. It’s like the rulebook Archer must meet before the Midnight can be certified to carry passengers.

🕓 Still Pending Before Passenger Flights Can Begin

Type Inspection Authorization (TIA) and full Type Certification. This is the FAA’s green light to begin official test flights that count toward certification. Once Midnight passes these tests, it can earn its final approval to carry passengers.

Production Certificate for the Georgia factory. This would confirm Archer’s assembly line can build aircraft to the FAA’s quality standards at scale. Without it, they can’t mass-produce the Midnight.

Part 142 Training Center. This certificate would allow Archer to set up advanced training programs for pilots using simulators and other tools.

Local approvals for routes and vertiports. Even if the aircraft is certified, Archer still needs city and airport permission to operate from specific locations, like LAX or Olympic venues in Los Angeles.

Where Do They Manufacture?

Archer completed construction of its ~400k sq ft high-volume plant (ARC) in Covington, Georgia, co-developed with Stellantis. Initial production begins ramping from early 2025 with a goal of ~2 aircrafts/month by year-end and a designed capacity up to ~650 aircrafts/year (phase 1), with room to expand to ~2,300/year. Engineering/flight test hubs remain in California

Why YOU Should Care:

Archer has been named the exclusive Official Air Taxi Provider for the LA28 Olympic and Paralympic Games and Team USA, under an exclusive U.S. deal announced in May 2025.

What That Means:

Archer’s Midnight eVTOL aircraft will be used to transport VIPs, fans, stakeholders, and provide support for emergency services and security during the Games.

The plan includes establishing vertiport hubs at key venues, for example: SoFi Stadium (Inglewood), the LA Memorial Coliseum, as well as vital travel locations including LAX, Hollywood, Orange County, and Santa Monica.

These eVTOLs are being produced in the U.S. (San Jose, CA and Covington, GA) and are designed for fast, low-emission, low-noise trips of roughly 10–20 minutes across L.A.

The deal also includes storytelling and media content integration through NBC Universal’s coverage of the 2026 and 2028 Olympic Games, including Opening and Closing Ceremonies.

Valuation Metrics (as of August 15th, 2025):

• Share price: ~$9.82

• Market cap: ~$6.33B

• 52‑week range: $2.82 - $13.92

• EPS (YoY) : -0.36

• P/E: -7.68 (since Archer has negative earnings the P/E isn’t comparable to profitable firms)

Key Insight: Archer’s negative P/E contrasts sharply with mainstream peers in its industry, all of which report positive (and generally moderate to high) P/E ratios. This reflects the company’s unprofitability versus the historically profitable legacy aerospace and defense firms.

Insider Activity:

Insider Ownership sits at ~6.5%. The largest holder is Stellantis sitting at ~9.4%. Other institutions hold a cumulative ~50.1%.

Leadership Matters:

Adam Goldstein, a co-founder, has been leading Archer since 2022 after Brett Adcock’s departure. Before Archer, Goldstein co-founded and led Vettery, an online hiring and recruiting marketplace. Vettery matched job seekers with employers, counting firms like Amazon, eBay, and JPMorgan among its clients. Goldstein led the company from around 2012 until its acquisition by the Adecco Group for over $100 million in 2019. Prior to his startup ventures, Goldstein worked in financial roles: portfolio manager at Plural Investments and co-managing partner at Minetta Lane Capital. He possesses both a Bachelor of Science in Business Administration from the University of Florida and an MBA from NYU Stern School of Business

Social & Sentiment:

Retail attention is relatively high at the moment. ARK added shares in late 2024, and LA naming elevated mainstream visibility. Still, investors are watching certification cadence closely.

Analyst Ratings:

•Recent coverage skews positive with 9 analyst giving ratings. The average price target is near $11 to $12 using various methodologies.

🐊 Gator Sense (Risk Awareness)

Investing involves both predictable and unpredictable risks. From black swan events like pandemics or nuclear war, to more expected risks such as regulation changes or companies fudging their books—no position is ever risk‑free.

Potential risks:

Certification Timing Risk - any slippage would push revenue out and impact the LA28 Olympic activation

Manufacturing Scale-Up Risk - Ramping a new aircraft to hundreds per year is non-trivial. Supply chain, batteries, and systems must mature.

Funding - Defense pipeline and pre-delivery payments may mitigate but do not eliminate cash needs.

🚨 Market Movers

• Named Official Air Taxi Provider for LA28 (May 2025).

• Began piloted Midnight test flights (June 2025).

• Part 141 approval for in-house pilot academy (Feb 2025).

• Ongoing manufacturing ramp in Georgia; target capacity up to 650/yr (phase 1).

• Anduril defense partnership & follow-on defense build-out (Dec 2024 → Aug 2025 updates).

📌 Chart Room

• 5-Year Price Chart

🧭 Off-the-Grid Insight

When Uber first appeared, many people judged it only by comparing it to the existing taxi industry. What they missed was that Uber wasn’t just a “better taxi.” By lowering friction, expanding supply, and re-wiring consumer expectations, Uber created a new category—rideshare—that grew far larger than the taxi market ever was.

Archer may be in a similar spot. If you only measure the opportunity by comparing it to today’s short-haul helicopter or shuttle flights, the numbers look limited. But Archer’s vision—quiet, clean, point-to-point air travel in minutes—could open a market we can’t fully size yet. Think about commutes replaced, highways unclogged, premium tourism experiences, medical transports, even entirely new types of urban planning once skies become a grid for mobility.

Just as few imagined Uber becoming the backbone of food delivery, freight, and global mobility, Archer’s total addressable market may be dramatically underestimated because the use cases don’t exist yet.

🐊 The Gator Pit

The Gator Pit Is Coming…

Right now, there’s no official community space—yet. But I know smart investors like you want a place to connect, compare notes, and sharpen your edge. That’s why I’m working on launching a private group on either Telegram, Discord, or Facebook—and I’d love your input.

👉 Which platform would you prefer? Reply to this email or tap the button below to vote. A place to swap insights, ask questions, and grow together is on the way. Stay tuned—the Gator Pit opens soon.

That’s All For Now!

See You Later, Invest‑a‑Gator 🐊

Get Started with Robinhood If you're interested in investing individual stocks or ETF’s, Robinhood offers a simple platform to buy and sell stocks with no commission fees. You can sign up using my referral link below and get a bonus when you start investing.

Disclosure: This is a referral link, and I may receive compensation if you sign up using it. Please note that this is not financial advice, and you should do your own research before making any investment decisions.

Disclaimer: This analysis is for informational purposes only and is not financial advice.

General Educational Purpose:

The information and services I provide are for educational and informational purposes only. They are not intended as financial advice or as a recommendation to buy, sell, or hold any security.

Personalized Investment Viewpoint:

My evaluations reflect my personal investment criteria, strategies, and goals. They are not tailored to any individual's financial situation or objectives.

No Financial Planning or Asset Management:

I do not offer financial planning services or manage assets on behalf of others. All insights and analyses are based solely on my personal investment research and decisions.

Transparency of Credentials:

I am not a certified financial advisor, and I do not possess formal financial education or certifications. My content is based on publicly available data and my personal opinions.

Use of AI:

Some content is crafted with the assistance of AI tools to streamline research and writing.