REITs Are Interesting:

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-producing real estate. They offer a unique way for investors to gain exposure to the real estate market without the hassle of directly buying, managing, or financing properties. REITs typically invest in a variety of commercial properties, such as shopping centers, office buildings, hotels, and even entertainment venues like theaters.

One of the key features of REITs is that by law, they must pay out at least 90% of their taxable income to shareholders in the form of dividends. This makes them an attractive option for income-seeking investors, as they provide a steady stream of income, often in the form of monthly or quarterly dividends.

In addition to the regular income from dividends, REITs can offer the potential for long-term capital appreciation, as the underlying value of the properties they own can increase over time. By investing in a REIT, you're not just investing in the individual properties but also in the company's ability to generate income from its portfolio of real estate assets.

Let’s look at the Fundamentals of EPR Properties

Stock Price: $43.18 (as of 18 December 2024)

52-Week High: $50.26

52-Week Low: $39.66

Dividend Yield: $0.285 per share (paid monthly)

EPS: 2.32

P/E Ratio: 19.48

It’s important to point out that in the past month the share price is down $0.92 or about 2% AND is down a little more $5.00 in the past year. The share price has lost approximately 10% of its value in the past 365 days. While this decline may give some investors pause, it could also present a buying opportunity for those who believe in the company’s long-term potential.

What Does EPR Properties Do?

EPR Properties is a diversified REIT that owns approximately 381 properties across 42 U.S. states and Canada. These properties fall into two main categories:

Experiential Properties (352 total):

Theatres: 159 properties

Eat-and-Play Venues: 58 properties

Attractions: 24 properties

Ski Resorts: 11 properties

Experiential Lodging: 7 properties

Gaming Facilities: 1 property

Cultural Venues: 1 property

Fitness and Wellness Centers: 22 properties

Educational Properties (69 total):

Early Childhood Education Centers: 60 properties

Private Schools: 9 properties

Dividend and Ex-Dividend Date Information:

EPR Properties pays a monthly dividend of $0.285 per share. To qualify for the upcoming dividend payout on January 15th, you must own shares before the Ex-Dividend date of December 31st.

REITs like EPR Properties are required to pay out at least 90% of their taxable profits to shareholders in the form of dividends, making them an appealing investment for income-seeking investors.

Institutional Ownership:

EPR Properties is heavily owned by large institutions, with over 70% of the company held by firms like Vanguard Group, BlackRock, and State Street. Institutional ownership can indicate confidence in the company's long-term prospects.

By investing in EPR Properties, you are participating in a portfolio of experiential and educational properties, which may appeal to those looking for a unique blend of long-term growth potential and reliable income through monthly dividends.

Why This Matters to You:

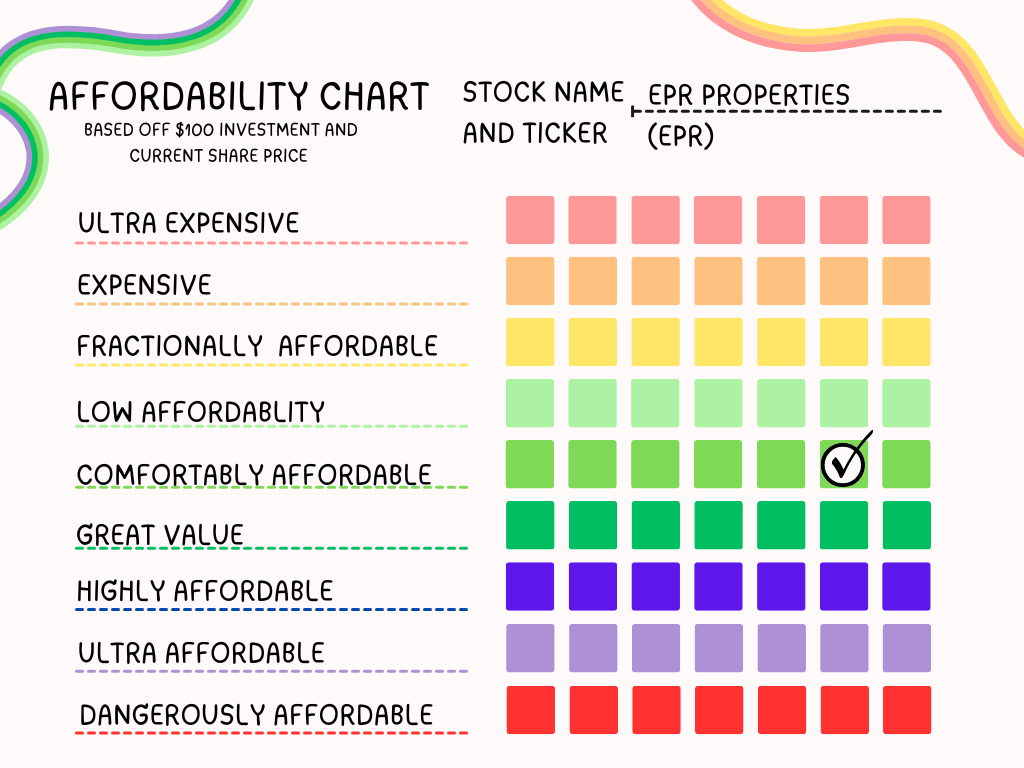

For me, as a father with a family to support, $100 makes a significant difference in my budget. That’s why I’ve created a visual aid to help assess the affordability of stocks like EPR Properties from my personal perspective.

Based on a $100 investment, this chart helps me gauge how affordable the stock is at its current price of $45.20. It’s important to note that this chart isn’t financial advice, nor does it suggest whether the stock is an ideal entry point. It’s simply a tool I use to assess the stock’s affordability relative to my own budget and investment strategy.

For example, for the price of a movie ticket and popcorn at the theater, you could own shares in 159 theaters (and other experiential properties) managed by EPR Properties. Maybe I’d rather get the overpriced popcorn at the theater, though!

Investing is Personal

Whether you’re new to investing or looking to diversify your portfolio, it’s crucial to assess how affordable a stock is relative to your own financial situation. Understanding what’s affordable to me might not be the same as what’s affordable for you, but this guide can help you assess your own budget and financial goals.

Investing isn’t just about buying stocks—it’s about making decisions that align with your personal financial needs and long-term goals. That’s why I’ve created this breakdown: to help you, just like me, make more informed decisions.

Get Started with Robinhood

If you're interested in investing in REIT’s or other stocks, Robinhood offers a simple platform to buy and sell stocks with no commission fees. You can sign up using my referral link below and get a bonus when you start investing.

Disclosure: This is a referral link, and I may receive compensation if you sign up using it. Please note that this is not financial advice, and you should do your own research before making any investment decisions.

IInvesting is Not Always About Money—It’s About Investing in Yourself

If you found this breakdown helpful, don’t forget to subscribe to my newsletter for more stock insights, analysis, and updates. I share my personal investing strategy and affordability scale to guide retail investors like you and me on our journey toward financial growth.

Taking the time to Read, Learn, and Investigate is an investment in yourself.

Sharing this newsletter is an investment in your family, friends, and community.

Here are some links to various resources to verify segments of this newsletter to start Investigating for yourself:

Disclaimer:

This is not financial or investment advice.

This information was put together in part using AI.