🔔 Opening Bell

Let’s Ring the Opening Bell and Learn Something New Today. In a world of noise and nonsense, smart investors start with signal. Let’s cut through the hype because you're not here for guesses—you’re here to build.

Amazon ($AMZN)

Ask yourself one simple question: Who is the CEO of Amazon? If your first thought was Jeff Bezos, you might want to take another look at this company. Bezos stepped aside in 2021, and Andy Jassy has quietly led Amazon ever since. The fact that most people don’t know his name is not a weakness—it’s a powerful strength. Amazon’s brand, scale, and machine-like operations are so deeply entrenched in everyday life that the business doesn’t hinge on a celebrity founder or a flashy personality. Instead, Amazon’s value lies in its systems: AWS powering the digital economy, Prime locking in households, and a logistics network that runs with near-military precision. In a market where too many companies are personality-driven, Amazon’s ability to thrive under a low-profile leader is exactly what makes it such a durable, long-term investment.

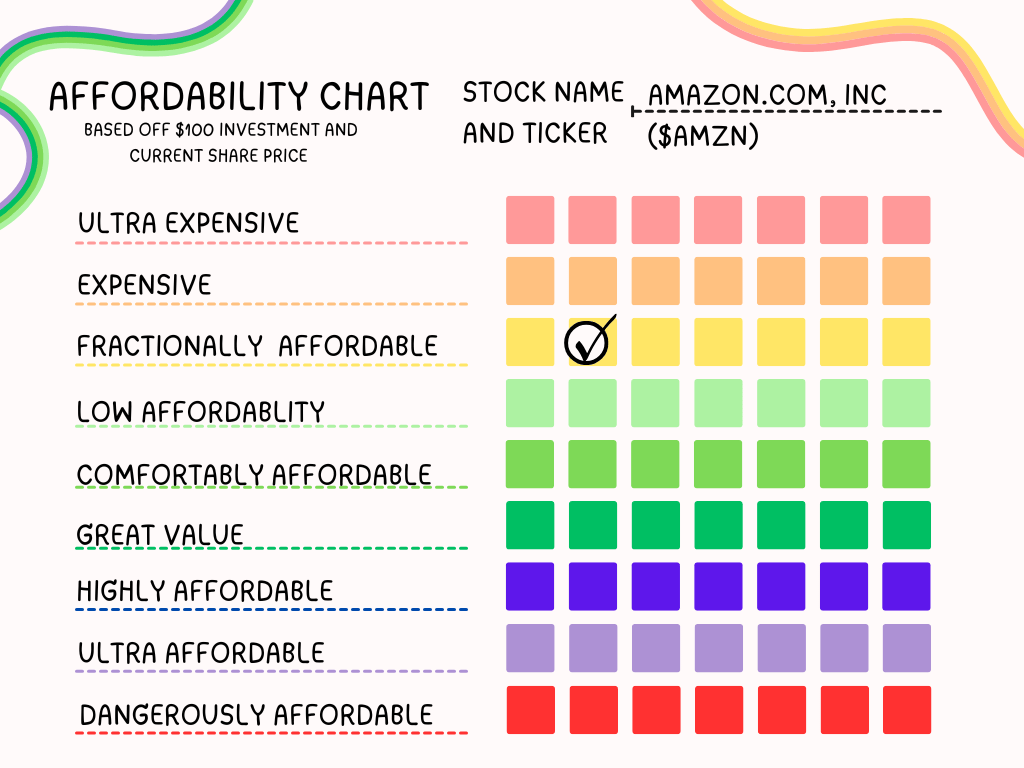

The “Vibe” $229.00 Feels Like

As a father with a family to support, $100 can either be a luxury or an investment. So I created a simple visual aid to check if a stock feels affordable. That $100 could cover six of my wife’s weekly Amazon purchases, little blue and white packages that show up like clockwork (and I still have no idea what’s inside). Or it could buy me nearly 0.44 shares of Amazon stock, a small piece of the $167 billion quarterly revenue from things like AWS, Prime, and that dangerously convenient “Buy Now with One Click”.

Key macro headlines:

Amazon's Q2 2025 net sales came in at $167.7 billion, beating analyst consensus estimates by $5.6 billion. AWS backlog reached $195 billion, and operating margins in AWS held strong at 36.8%—driving over 50% of operating profits

TradingNews analysis suggests Amazon is trading at a ~29% discount to fair value, with potential for ~45% upside to a target around $324 in the next 12 months

Institutional sentiment is bullish: 14 "Buy" and 11 "Strong Buy" ratings in the last 20 days, even as technical indicators remain neutral

💬 Ask & Interact

• Recommended read: The Intelligent Investor by Benjamin Graham—a perennial classic on value and margin of safety.

• Have a question on $AMZN ( ▲ 1.0% ) or other investments? Submit your queries for future deep dives.

🔍 Deep Dive: RITM (Rithm Capital Corp.)

Summary:

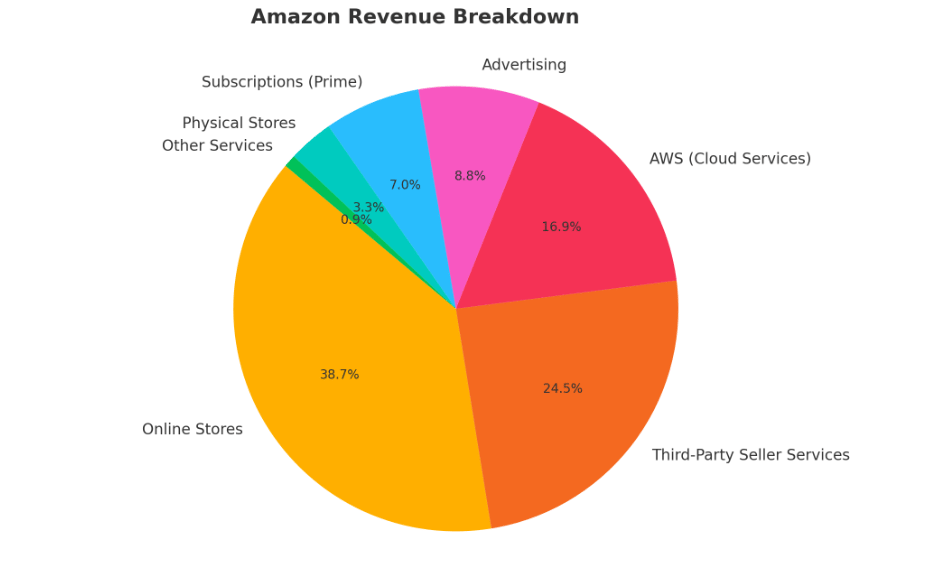

Amazon.com is a global e-commerce and cloud computing giant. It generates revenue through retail sales, third-party seller services, subscriptions (Prime), advertising, and AWS—supported by a robust infrastructure and diversified portfolio of subsidiaries like Whole Foods, Twitch, Ring, IMDb, and more

Getting into the Swamp:

If you are considering putting money into investing in Amazon, you should know how Amazon makes revenue. Here is Amazon’s Revenue Breakdown:

Slice | Percentage of Total Revenue | What It Means |

|---|---|---|

Online Stores | 38.7% | People buy stuff directly from Amazon. This is what most people think of when you (or your wife) buy something on Amazon.com Profits are thin. |

Third-Party Seller Fees | 24.5% | Millions of sellers list their stuff on Amazon. Amazon takes a cut of every sale. |

AWS (Cloud Services) | 16.9% | Companies rent out servers, storage, and cloud computing power from Amazon. AWS is only 16.9% of total sales, but it delivers over 50% of operating profit. This is Amazon’s Cash Cow |

Advertising | 8.8% | Businesses pay Amazon to show ads. Their ad business is now bigger than YouTube’s. Crazy high profit-margins. |

Subscriptions (Prime) | 7.0% | People pay for perks like fast shipping and video and music. These perks lock people into shopping more. |

Physical Stores | 3.2% | Whole Foods, Amazon Go convenience stores, and Amazon Fresh. Part of Amazon’s strategy to dominate grocery retail. |

Other Services | 0.9% | Miscellaneous bits like credit card partnerships. |

There’s a small piece of Amazon that is generally underappreciated in my opinion. I think it’s hinted at by Jeff Bezos’s December 2024 quote “Somebody needs to make a list where they rank people by how much wealth they’ve created for other people instead of the Forbes list… Then I’ve created something like $2.1 trillion in wealth for other people. That should put me pretty high on some kind of list—and that’s a better list.”

Arguably there are 50 ways to make money from Amazon. So let me try and list them (yes, some may be similar, but there are differences between each listed item)

Amazon FBA (Fulfillment by Amazon): List products, let Amazon Handle storage, packing, and shipping

FBM (Fulfilled by Merchant): Sell on Amazon, but handle logistics yourself

Private Labeling: Source or create products, brand them, sell through Amazon’s marketplace

Wholesale Arbitrage: Buy products cheaply elsewhere and resell on Amazon for a margin

Amazon Associates Affiliate Program: Earn commissions by linking products in blogs, YouTube, or social media

Merch by Amazon: Upload T-shirt or merchandise designs, Amazon prints and ships them when sold

Kindle Direct Publishing (KDP): Publish ebooks or paperbacks and earn royalties

Amazon Handmade: Sell handcrafted goods, etsy-style

Amazon Influencer program: Curate a storefront with product recommendations and earn commissions

Cloud Consulting and Development: Build apps or tools on AWS and charge clients

SaaS products on AWS Marketplace: Sell your software services via Amazon’s cloud platform

Prime Video Direct: Publish films, series, or video content and get paid per stream

Audible Publishing (ACX); Create and sell audiobooks

Amazon Music for Artists: Upload and monetize music

Reselling Amazon Gift Cards: Buy discounted Card and flip them for profit

Work at an Amazon Warehouse: earn wages through fulfillment center job

Work at an Amazon physical store: Jobs at Whole Foods, Amazon Fresh

Amazon Flex: Deliver packages as an independent contractor

Invest in Amazon stock: capture long-term gains from one of the most valuable companies in the world

I could go on listing examples, but I’m pretty sure you stopped reading after the fourth one. The point remains: each of these is part of the $2.1 trillion Bezos referenced—not just shareholder value, but income streams for creators, sellers, developers, drivers, and investors.

And speaking of investors, Amazon itself is a prolific one. Beyond retail and AWS, the company has quietly deployed billions into bets ranging from healthcare to autonomous vehicles to satellite broadband. It owns Twitch in streaming, PillPack/Amazon Pharmacy in prescriptions, One Medical in healthcare, Zoox in self-driving cars, Ring and Eero in smart homes, and is pouring $10 billion into Project Kuiper, its satellite internet venture. It also maintains a significant stake in Rivian, whose electric delivery vans are already reshaping Amazon’s logistics fleet.

Over the last decade, Amazon has invested heavily in robotics, EVs, and autonomy with one clear endgame: a logistics network that runs with minimal human touch. It began with the acquisition of Kiva Systems in 2012, transforming warehouses into robotic symphonies where hundreds of thousands of bots now pick, pack, and move goods with near-perfect efficiency. That foundation has grown into Amazon Robotics, pushing automation deeper into every corner of fulfillment.

Now the company is extending automation outside the warehouse. Rivian is delivering electric vans at scale, cutting costs and emissions. The bigger leap is Zoox, Amazon’s fully owned autonomous vehicle subsidiary, building cars designed from the ground up for self-driving urban mobility. Combine Zoox with Amazon’s advances in AI, computer vision, and robotics, and the long-term vision becomes clear: fleets of electric, driverless robots delivering packages across cities with no human in sight.

If even a handful of these bets succeed, the ROI is enormous. Amazon is already the quiet, unrecognized leader in robotics. Healthcare and satellite internet are multitrillion-dollar markets, while Rivian and Zoox could redefine logistics efficiency. Layer that on top of AWS’s profitability, and Amazon’s role as a prolific investor means it isn’t just selling goods today—it’s buying options on the industries of tomorrow.

Valuation Metrics (as of September 1st, 2025):

• Share price: ~$229.00

• Market cap: ~$2.4 - $2.5 trillion

• 52‑week range: $161.38 to $242.52

• Forward P/E ~ 34.6

Insider Activity:

Jeffrey Bezos, the founder, sold over 100,000 shares at an undisclosed price on August 14th. He still retains over 8% ownership of Amazon with over 883 million shares. 6621 Institutional Investment Firms like Vangaurd, BlackRock, and State Street own a collective 65% of Amazon.

Leadership Matters:

Jeff Bezos founded Amazon in 1994 and led the company until 2021. In 2021 he stepped down from the role of CEO and into the role of executive chair. Since 2021 Andy Jassy has been driving over 375 opertional improvements based on employee feedback, and is steering Amazons AI investments. Andy Jassy has been with Amazon since 1997, and in 2006 was involved with the launch of Amazon Web Services (AWS) with a small team of 57 individuals. AWS grew into a dominant cloud infrastructure business, Jassy became CEO of AWS in 2016. In January of 2021 he was named Amazon’s CEO and officially took over from Bezos in July.

Social & Sentiment:

Fairly low social visibility as it tends to fly under the radar despite high yield. Occasional coverage on dividend-focused investing platforms highlights its income story and valuation merits.

There has been recent coverage in Seeking Alpha Business Wire daily news and CEO interviews available from Q2 earnings webcast.

Analyst Ratings:

• Recent ratings: 14 Buy and 11 Strong Buy in the past 20 days

• Median 12‑month target: ~$195 on the low to $305 on the high end, with an average of $262.87

🐊 Gator Sense (Risk Awareness)

Investing involves both predictable and unpredictable risks. From black swan events like pandemics or nuclear war, to more expected risks such as regulation changes or companies fudging their books—no position is ever risk‑free.

Potential risks:

Escalating competition in cloud could pressure AWS growth and margins

High P/E valuation means any deceleration in growth or market sentiment could trigger sharp corrections.

Project Kuiper is a $10B moonshot that could become a money pit of Starlink dominates

🚨 Market Movers

• Strong Q2 results and AWS strength

• Bullish analyst re-ratings and sentiment

🧰 Toolbox

If you invest $100 at current price $229.00:

• Shares = 0.44 shares (approx).

• Annual dividend income: Amazon doesn’t pay a dividend, so annual income is $0

📌 Chart Room

• 5-Year Price Chart

Amazon stock shows growth of 39.01% or an increase of $64.27 over the past 5 years

🧭 Off-the-Grid Insight

The time to invest in Amazon is before its moonshots hit. For four years, Andy Jassy has quietly steered Amazon, delivering a steady averaged ~10% annual return while building the foundation for robotics, autonomous delivery, healthcare, and satellite internet. These projects may one day be so disruptive they spark conversations about Universal Basic Income—but by the time that future arrives, the upside will already be priced in. The opportunity is now, while Amazon is still being underestimated as “just an online retailer.”

🐊 The Gator Pit

The Gator Pit Is Coming…

Right now, there’s no official community space—yet. But I know smart investors like you want a place to connect, compare notes, and sharpen your edge. That’s why I’m working on launching a private group on either Telegram, Discord, or Facebook—and I’d love your input.

👉 Which platform would you prefer? Reply to this email or tap the button below to vote. A place to swap insights, ask questions, and grow together is on the way. Stay tuned—the Gator Pit opens soon.

That’s All For Now!

See You Later, Invest‑a‑Gator 🐊

Get Started with Robinhood If you're interested in investing individual stocks or ETF’s, Robinhood offers a simple platform to buy and sell stocks with no commission fees. You can sign up using my referral link below and get a bonus when you start investing.

Disclosure: This is a referral link, and I may receive compensation if you sign up using it. Please note that this is not financial advice, and you should do your own research before making any investment decisions.

Disclaimer: This analysis is for informational purposes only and is not financial advice.

General Educational Purpose:

The information and services I provide are for educational and informational purposes only. They are not intended as financial advice or as a recommendation to buy, sell, or hold any security.

Personalized Investment Viewpoint:

My evaluations reflect my personal investment criteria, strategies, and goals. They are not tailored to any individual's financial situation or objectives.

No Financial Planning or Asset Management:

I do not offer financial planning services or manage assets on behalf of others. All insights and analyses are based solely on my personal investment research and decisions.

Transparency of Credentials:

I am not a certified financial advisor, and I do not possess formal financial education or certifications. My content is based on publicly available data and my personal opinions.

Use of AI:

Some content is crafted with the assistance of AI tools to streamline research and writing.