🔔 Opening Bell

Let’s Ring the Opening Bell and Learn Something New Today. In a world of noise and nonsense, smart investors start with signal. Let’s cut through the hype because you're not here for guesses—you’re here to build.

Rithm Capital Corporation (RITM)

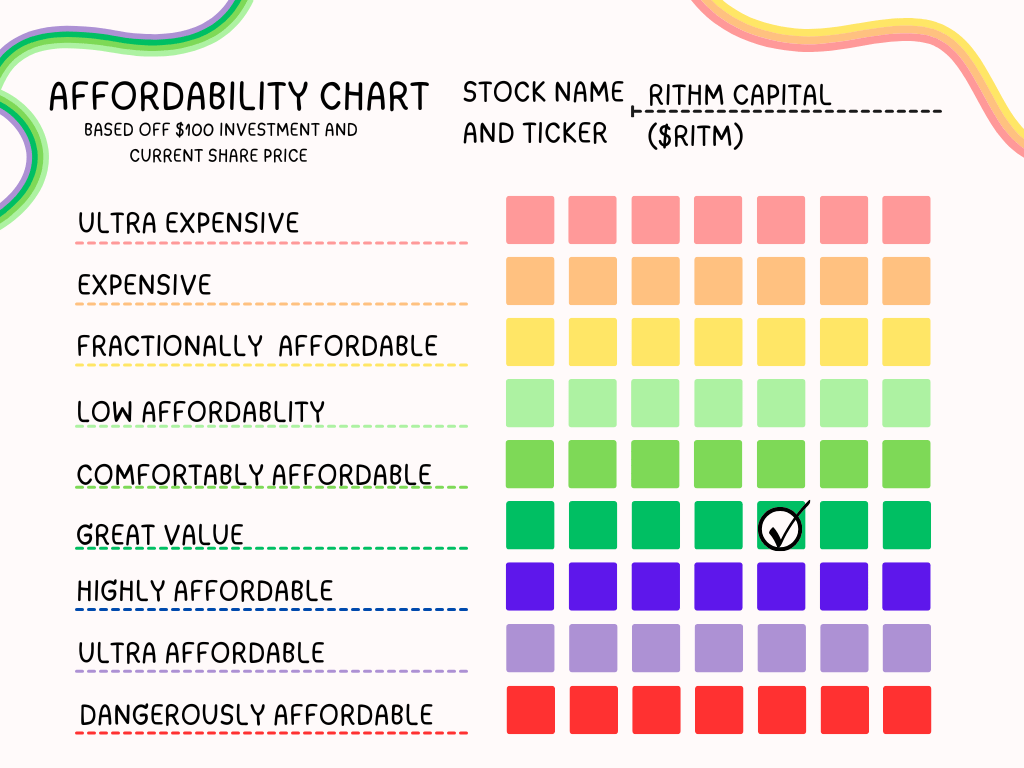

The “Vibe” $12.03 Feels Like

As a father with a family to support, $100 can either be a luxury or an investment. So I created a simple visual aid to check if a stock feels affordable. That $100 buys me nearly 8 shares - and those shares bring in about $8 a year just from other people paying their mortgages. I'm still writing checks every month for my mortgage, but at least now one small check is coming back my way. In a $8 kind of way it is giving landlord energy without a tenant headache of midnight calls of clogged toilets.

📈 Market Pulse

• Dow Jones: ▼ 330.30 points to 44,130.98

• S&P 500: ▼ 23.51 points to 6,339.39

• NASDAQ Composite: ▼ 7.23 points to 21,122.45

Key macro headlines:

Mortgage rates remain elevated, impacting real estate financials.

At the July 29–30, 2025 FOMC meeting, the federal funds rate was held steady at 4.25%–4.50%

Chair Powell and most Fed officials emphasized a data-driven approach, making no commitment to a rate cut in September

Two Fed governors—Michelle Bowman and Christopher Waller dissented, advocating for an immediate rate cut of 25 basis points

💬 Ask & Interact

• Recommended read: The Intelligent Investor by Benjamin Graham—a perennial classic on value and margin of safety.

• Have a question on RITM or other investments? Submit your queries for future deep dives.

🔍 Deep Dive: RITM (Rithm Capital Corp.)

Summary:

Rithm Capital Corp. is a US-based asset manager specializing in real estate and credit investments. It includes mortgage servicing rights (MSR) platforms like Newrez and Genesis, residential transitional mortgage lending (RTL), and alternative asset management via its ownership of Sculptor Capital Management. Its blend of high-yield income and asset diversification makes it one of the more hybrid-like REITs on the market.

Getting into the Swamp:

MSRs generate income from collecting payments on mortgage loans—think of it like a subscription fee tied to a home loan. However, their value drops when borrowers refinance early or sell their homes, since the servicer loses future fee income. Because MSRs are sensitive to interest rate movements (especially when rates fall), Rithm hedges that risk through a combination of:

1. Interest Rate Derivatives

• Tools like swaps, swaptions, Treasury futures, and options help offset valuation losses when rates decline.

• If MSRs lose value because rates drop, derivatives gain value to help balance the loss.

2. Origination Offsets

• Rithm owns Newrez, a large mortgage originator.

• So when rates fall and MSRs get hit, loan originations spike—offsetting the MSR loss with higher origination profits.

3. Active Trading of MSRs

• Rithm actively buys, sells, and securitizes MSR pools based on rate outlooks and prepayment speeds.

• This allows them to monetize MSR assets before potential value erosion.

4. Diversified Loan Exposure

• They manage both agency and non‑agency MSRs, which have different behaviors under stress.

• This reduces concentration risk tied to any one loan type or borrower class.

Without hedging, a drop in rates could crush MSR valuations, dragging down earnings. Rithm’s integrated platform (MSRs + origination + capital markets) provides a natural hedge, making earnings more stable across cycles.

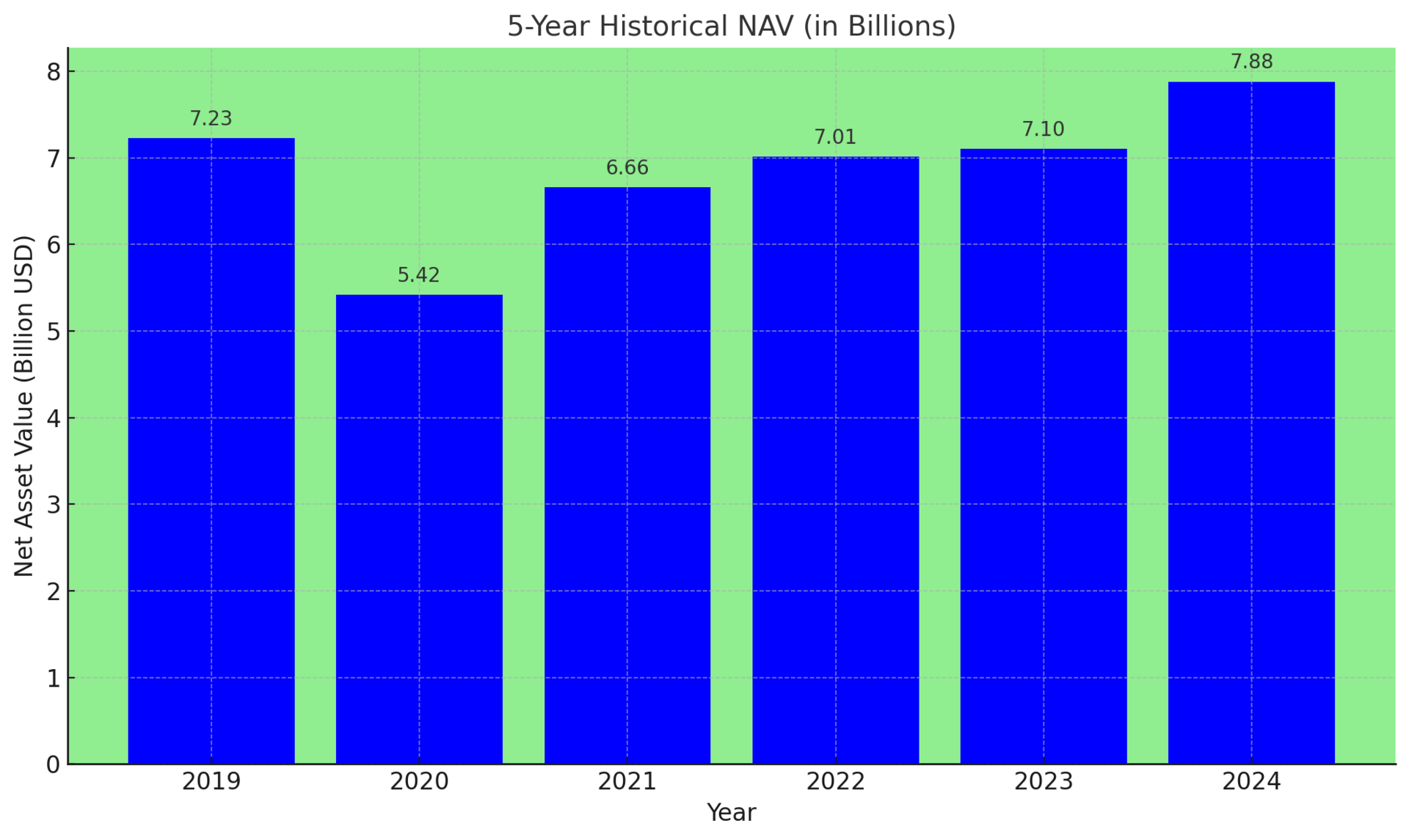

Valuation Metrics (as of July 30–31, 2025):

• Share price: ~$12.03–12.06

• Market cap: ~$6.3–6.4B

• Dividend yield: ~8.3%, dividend ~$1.00 annually

• 52‑week range: $9.13–12.59

• FFO (Q2): Not explicitly broken out, but Earnings Available for Distribution (EAD) — often analogous to AFFO — was $291.1M

Insider Activity:

The CEO recently sold ~106 thousand common shares in the middle of June. I’d suggest not reading to much into this activity at this time though. Warren Buffet has famously said, “"The smartest insiders sell their stock for many reasons,…”. Institutional investors like BlackRock and BofA adjusted positions: Kingstone Capital added ~9.3M shares in Q2, while BlackRock trimmed ~2.3M shares recently.

Leadership Matters:

CEO & Chairman Michael Nierenberg currently leads the firm. Rithm spun out from New Residential as an internally managed vehicle in 2022 to shed external manager fees and attract longer-term investors.

Led by multiple senior-aligned asset management executives, average leadership experience ~31 years. No founder involvement noted; its structure evolved post-2011.

Social & Sentiment:

Fairly low social visibility as it tends to fly under the radar despite high yield. Occasional coverage on dividend-focused investing platforms highlights its income story and valuation merits.

There has been recent coverage in Seeking Alpha Business Wire daily news and CEO interviews available from Q2 earnings webcast.

Analyst Ratings:

• Recent ratings: UBS, RBC, Wedbush, Piper Sandler, Jones Trading—all favor provided Buy/Outperform/Overweight

• Median 12‑month target: ~$14.0 (upside ~12‑16%).

🐊 Gator Sense (Risk Awareness)

Investing involves both predictable and unpredictable risks. From black swan events like pandemics or nuclear war, to more expected risks such as regulation changes or companies fudging their books—no position is ever risk‑free.

Potential risks:

Mortgage interest rate volatility could reduce margin from MSR hedging.

Exposure to non-qualified mortgage (non-QM) loans and transitional lending could see higher losses if housing or developer stress increases. (Check out the last bullet in the Market Movers Section to understand more)

Servicing asset prepayment risk or deteriorating broader credit conditions.

🚨 Market Movers

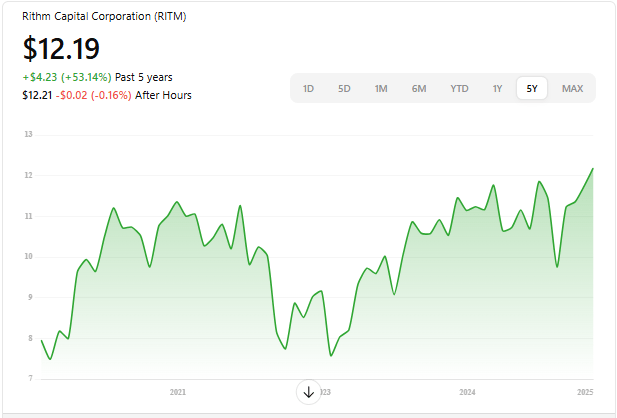

• Q2 2025 earnings (announced July 28, 2025): Earnings Per Share (EPS) of $0.54 beat the $0.52 analysts’ estimate (or $0.53 by some sources).

• Revenue for quarter: ~$1.22B, beat weak expectations. However it is a modest decline of ~1% year over year (YoY).

• Asset servicing portfolio UPB reached ~$864B (+7% YoY), including $271B third‑party servicing.

• Rithm’s asset management arm (Sculptor and internal operations) saw strong inflows, new managed account for RTL loans aimed at $1.5B scale

• Company highlighting strategic growth in asset management, M&A, and tech investments like Rezi AI for servicing efficiency.

• Recently completed a $504M securitization of non‑QM residential loans and priced senior unsecured notes to fund acquisition of transitional loan portfolios

🧰 Toolbox

If you invest $100 at current price $12.03:

• Shares = 8 shares (approx).

• Annual dividend income: 8 × $1.00 = ~$8.00 (yield ≈ 8%).

📌 Chart Room

• 5-Year Price Chart

🧭 Off-the-Grid Insight

Consider how rising mortgage rates and credit tightening could pressure MSR hedging and asset valuations. A counter‑play: long RITM into eventual rate normalization, capturing high yield—but with caution around duration risks.

🐊 The Gator Pit

The Gator Pit Is Coming…

Right now, there’s no official community space—yet. But I know smart investors like you want a place to connect, compare notes, and sharpen your edge. That’s why I’m working on launching a private group on either Telegram, Discord, or Facebook—and I’d love your input.

👉 Which platform would you prefer? Reply to this email or tap the button below to vote. A place to swap insights, ask questions, and grow together is on the way. Stay tuned—the Gator Pit opens soon.

That’s All For Now!

See You Later, Invest‑a‑Gator 🐊

Get Started with Robinhood If you're interested in investing individual stocks or ETF’s, Robinhood offers a simple platform to buy and sell stocks with no commission fees. You can sign up using my referral link below and get a bonus when you start investing.

Disclosure: This is a referral link, and I may receive compensation if you sign up using it. Please note that this is not financial advice, and you should do your own research before making any investment decisions.

Disclaimer: This analysis is for informational purposes only and is not financial advice.

General Educational Purpose:

The information and services I provide are for educational and informational purposes only. They are not intended as financial advice or as a recommendation to buy, sell, or hold any security.

Personalized Investment Viewpoint:

My evaluations reflect my personal investment criteria, strategies, and goals. They are not tailored to any individual's financial situation or objectives.

No Financial Planning or Asset Management:

I do not offer financial planning services or manage assets on behalf of others. All insights and analyses are based solely on my personal investment research and decisions.

Transparency of Credentials:

I am not a certified financial advisor, and I do not possess formal financial education or certifications. My content is based on publicly available data and my personal opinions.

Use of AI:

Some content is crafted with the assistance of AI tools to streamline research and writing.