🔔 Opening Bell

Let’s Ring the Opening Bell and Learn Something New Today. In a world of noise and nonsense, smart investors start with signal. Let’s cut through the hype because you're not here for guesses—you’re here to build.

Before we dive into the under-the-radar stock that quietly beats the Nasdaq‑100 Index, let’s first make sure we understand what that index actually is.

The Nasdaq‑100 Index is a collection of 100 of the largest non-financial companies listed on the Nasdaq Stock Exchange. It includes well-known names like Apple, Microsoft, Nvidia, and Amazon. Because of this, the index is often used as a snapshot of the technology sector and the broader innovation-driven economy.

Historically, the Nasdaq‑100 has delivered strong long-term returns—averaging around 13% to 15% annually over the past 20 years. But like most growth-focused investments, it can also be volatile in the short term.

If you want to explore the index yourself, you can look it up using terms like "Nasdaq 100", "NDX", or through its popular Exchange Traded Fund (ETF) counterpart, the QQQ, which is designed to mirror and match the index’s performance.

Now, what one stock outperforms the $QQQ? Its the company that owns the licensing rights to the term “Nasdaq-100 Index”. Say hello to:

Nasdaq ($NDAQ)

The “Vibe” buying $94.75 Feels Like

As a father with a family to support, $100 can either be a luxury or an investment. So I created a simple visual aid to check if a stock feels affordable. That $100 buys me slightly more than a single share of the infrastructure that runs the market where companies like Apple and Amazon live. A small piece of a business that prints revenue when other people buy stocks, list IPO’s, or subscribe to data. That one share will earn me about $1.15 per year and compound in value every year. It’s not a jackpot. Its a steady drip of the small cut of the fees and services other companies are paying everyday.

Key macro headlines:

Nasdaq, Inc. ($NDAQ) stock trades near its 52 week high, reflecting ongoing strength

The company continues to expand its financial technologies and data services, including work on Agentic AI for Anti-Money Laundering compliance and enhancements via Verafin and Amazon Web Services partnerships

💬 Ask & Interact

• Recommended read: The Intelligent Investor by Benjamin Graham—a perennial classic on value and margin of safety.

• Have a questions on ETF’s or other investments? Do you want to pick the ticker or topic of future deep dives? Email me with your questions and requests!

🔍 Deep Dive: NDAQ (Nasdaq, Inc.)

Summary:

Nasdaq, Inc. operates the Nasdaq Stock Market, but its revenues come from three core segments:

Listings/Capital Access (~42.5%)

Market Services/Data (~22.5%)

Financial Technology (~35%)—including software, regulatory compliance, and financial crime solutions

Sector / Industry

Nasdaq, Inc. is classified under the Financials sector, specifically within the Capital Markets industry grouping (which includes stock exchanges, trading venues, and market infrastructure providers)

Nasdaq's primary competitors are other major global exchange and capital markets operators:

Intercontinental Exchange (ICE) – owner of the New York Stock Exchange and numerous clearing, data, and trading platforms.

London Stock Exchange Group (LSEG) – a diversified exchange and financial infrastructure group, including LSE, FTSE indices, data, and analytics.

Cboe Global Markets (CBOE) – operator of prominent exchanges and options venues, including the Chicago Board Options Exchange.

Getting into the Swamp:

🔷 1. Listings / Capital Access (~42.5%)

What it is:

This is the business of being the stock exchange. Companies that want to go public—like Apple once did—list their shares on the Nasdaq exchange.

How it makes money:

Initial listing fees: Charged when a company first IPOs on Nasdaq.

Annual fees: Public companies pay yearly to stay listed.

Corporate services: Nasdaq sells tools to help public companies with:

Investor relations (communicating with shareholders)

ESG reporting tools (Environmental, Social, Governance)

Governance services like shareholder voting tools

Why it matters:

Nasdaq is competing with the NYSE for new listings, especially in tech and global markets. Having big names like Apple, Microsoft, and Amazon keeps prestige high.

📊 2. Market Services / Data (~22.5%)

What it is:

This covers the operations of running the marketplace—matching buyers and sellers—and selling the data that gets generated.

How it makes money:

Trading fees: For every transaction (buy/sell) on Nasdaq, a small fee is collected.

Market data sales: Nasdaq sells real-time and historical price data to:

Brokerages (like TD Ameritrade, Robinhood)

Hedge funds and asset managers

Media outlets (like CNBC or Bloomberg)

Colocation services: High-frequency trading firms pay premium to place their servers physically close to Nasdaq's data centers for faster execution speeds.

Why it matters:

This is a recurring, scalable revenue stream tied to trading volumes and demand for high-quality market data.

🖥 3. Financial Technology (~35%)

What it is:

This is Nasdaq's fastest-growing and most strategic segment. It includes all their software businesses, especially in fraud detection, compliance, and market infrastructure.

Key components:

Verafin: Anti-financial crime software for banks. Detects money laundering, fraud, and suspicious activity.

Adenza (formerly Calypso): Risk and compliance platforms used by financial institutions and exchanges worldwide.

Market technology: Nasdaq licenses its trading platforms to other global exchanges.

Cloud services: Partnering with AWS to deliver AI/AML tools (like Agentic AI) via the cloud.

How it makes money:

Software licensing (SaaS): Recurring fees for using Nasdaq’s fintech platforms.

Professional services: Implementation, training, support.

Data/analytics: Value-added tools for compliance, surveillance, and risk reporting.

Why it matters:

This segment positions Nasdaq as a fintech provider, not just an exchange. It gives the company more diverse, subscription-based revenue sources, less tied to market cycles.

The operation and licensing of the Nasdaq‑100 Index fits primarily into Nasdaq Inc.’s:

📊 Market Services/Data segment.

Here’s Why:

The Nasdaq‑100 Index is a market product, and revenue related to it comes from:

Index licensing (for ETFs like QQQ)

Market data subscriptions (real-time and historical index data)

Royalties from structured products and funds that track the index

These activities are part of data and index services, which are typically rolled up into the Market Services or Index/Data Services subcategories depending on Nasdaq’s reporting structure.

Valuation Metrics (as of August 24th, 2025):

• Share price: ~$94.75

• Market cap: ~$54.4 Billion

• Dividend yield: ~1.15%, dividend or ~$1.08 annually

• 52‑week range: $64.84 to $97.63

• P/E Ratios: ~36.44 trailing, and Forward ~29.07

🔍 What This Suggests:

If the P/E ratio is projected to drop from 36.44 to 29.07, it means:

Analysts expect Nasdaq Inc. to grow its earnings over the coming year.

Price stays relatively stable, while earnings per share (EPS) is expected to rise.

Investors are still paying a premium, but slightly less per dollar of future earnings. Although precise industry-wide (Capital Markets / Exchanges) average P/E data is hard to pin down directly, we can use peer P/E levels to gauge context:

ICE's current P/E ratio stands at approximately 34.48, compared with its long-term average of 25.43

Nasdaq’s own P/E (trailing) is around 36.4, with a forward P/E near 29 .

This suggests Nasdaq is trading at a premium both relative to ICE’s historical average and possibly to the average for the sector—indicating that investors are assigning a growth or strategic premium to Nasdaq’s future earnings.

🔍 Broader Picture

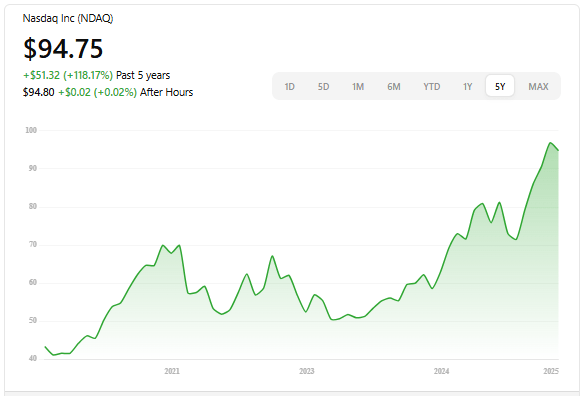

Over the past 5 years, Nasdaq, Inc. has delivered an annualized return of approximately 18.60%. Compared to the Nasdaq‑100 index that has produced an estimated 15.1% per annum over a 5-year period. So, Nasdaq, Inc. has outperformed the broader Nasdaq‑100 benchmark over the last 5 years on a compounded annual return basis by about 3–3.5 percentage points.

Insider Activity:

Over the past 24 months, insiders bought ~14,000 shares ($705,880 total), while selling ~73.9 million shares worth ~$4.57 Billion. In the past 3 months alone, insiders sold approximately $1 Million in shares.

Leadership Matters:

Adena T. Friedman – CEO & Chair, Nasdaq, Inc.

Early Career & Nasdaq Tenure

Joined Nasdaq in 1993 as an unpaid intern after completing her MBA

Rose through roles including Head of Data Products and Chief Financial Officer, playing a central role in key acquisitions like INET, OMX, the Philadelphia Stock Exchange, and the Boston Stock Exchange.

Interim Role at Carlyle

In 2011, she left to become CFO and Managing Director at The Carlyle Group, returning to Nasdaq in 2014 as President, overseeing its technology, information, and corporate businesses.

CEO & Chair

Became CEO on January 1, 2017, the first woman to lead a global exchange

Elevated to Chair of the Board in January 2023 .

Leadership Vision & Impact

Friedman has transformed Nasdaq’s identity into that of a technology-forward global exchange, championing AI, cloud infrastructure, and fintech expansion.

Her focus on diversity and inclusiveness—such as requiring board-level diversity disclosures—has had tangible impact, even though later subject to legal challenges.Recognition & Influence

Ranked among Forbes' "World’s Most Powerful Women" and Fortune’s similar lists for several years . Her total compensation in 2023 was approximately $18.5 million, with a CEO-to-median worker pay ratio of 157-to-1 according to Wikipedia.

Additionally, she serves as a Class B director at the Federal Reserve Bank of New York and on the board of FCLTGlobal, which promotes long-term investing strategies.Personal Notes

Friedman holds a black belt in taekwondo, a discipline she credits with instilling fearlessness and strategic discipline in business. She is married with two sons and resides in Maryland.

Board of Directors (Selected Members)

Here are some prominent board members providing governance alongside Friedman:

Mickie Rosen – CEO of BetterUp

Monique F. Leroux – President of the International Cooperative Alliance

Charlene T. Begley – Former CEO, GE Home and Business Solutions

Wendy J. Lane – Managing Partner, Lane Holdings, Inc.

Michael R. Splinter, Melissa M. Arnoldi, H.E. Essa Kazim, Thomas A. Kloet, Kathryn A. Koch, and Holden Spaht – Board members with diverse expertise across industries.

This board reflects a blend of leadership and strategic oversight across sectors—finance, technology, governance, and international markets.

Social & Sentiment:

Nasdaq Inc. ($NDAQ) has relatively low social visibility, often flying under the radar despite its strong performance. Coverage tends to cluster around earnings releases, with few standalone articles outside of those events. By contrast, most online content and videos focus on the Nasdaq-100 Index itself or ETFs like QQQ that track it. Direct discussion of $NDAQ as a stock remains limited and comparatively sparse.

Analyst Ratings:

• Analyst consensus on Business Insider: 42 Buy, 11 Hold, 0 Sell, median target ~$83.49 (below current price)

🐊 Gator Sense (Risk Awareness)

Investing involves both predictable and unpredictable risks. From black swan events like pandemics or nuclear war, to more expected risks such as regulation changes or companies fudging their books—no position is ever risk‑free.

Potential risks:

Concentrated Insider Selling: High volume sales by top executives may signal caution or diversification, potentially dampening sentiment.

Valuation Premium: Elevated trailing and forward P/E ratios may leave limited room for share price growth and a soft earnings report could trigger a price pullback

Execution Risk in New Ventures: Revenue from fintech and AI initiatives may take time to materialize and could additionally face integration hurdles.

🚨 Market Movers

• Q2 2025 earnings beat expectations ($0.85 EPS vs. expected ~$0.81) on revenue of ~$1B

• Nasdaq declared a quarterly dividend (~$0.27/share) payable September 26, 2025

🧰 Toolbox

If you invest $100 at current price $94.75:

• Shares = 1.055 shares (approx).

• Annual dividend income: 1.055× $1.08 = ~$1.14 (yield ≈ 1.14%).

📌 Chart Room

• 5-Year Price Chart

The Five Year Share Price Chart

🧭 Off-the-Grid Insight

If I had to choose a single stock to bet on outperforming the Nasdaq-100 Index, I’d put my money on the company that actually owns the index itself. Nasdaq Inc. doesn’t just operate the market—it collects the intellectual property and licensing fees every time an ETF like QQQ is traded or an index-linked product is created. Historically, $NDAQ has outpaced the Nasdaq-100 by about 2–4% annually. That edge may not sound huge, but compounded over years it adds up fast. Owning the house, rather than just playing inside it, is a smarter long-term bet in my opinion.

🐊 The Gator Pit

The Gator Pit Is Coming…

Right now, there’s no official community space—yet. But I know smart investors like you want a place to connect, compare notes, and sharpen your edge. That’s why I’m working on launching a private group on either Telegram, Discord, or Facebook—and I’d love your input.

👉 Which platform would you prefer? Reply to this email or tap the button below to vote. A place to swap insights, ask questions, and grow together is on the way. Stay tuned—the Gator Pit opens soon.

That’s All For Now!

See You Later, Invest‑a‑Gator 🐊

Get Started with Robinhood If you're interested in investing individual stocks or ETF’s, Robinhood offers a simple platform to buy and sell stocks with no commission fees. You can sign up using my referral link below and get a bonus when you start investing.

Disclosure: This is a referral link, and I may receive compensation if you sign up using it. Please note that this is not financial advice, and you should do your own research before making any investment decisions.

Disclaimer: This analysis is for informational purposes only and is not financial advice.

General Educational Purpose:

The information and services I provide are for educational and informational purposes only. They are not intended as financial advice or as a recommendation to buy, sell, or hold any security.

Personalized Investment Viewpoint:

My evaluations reflect my personal investment criteria, strategies, and goals. They are not tailored to any individual's financial situation or objectives.

No Financial Planning or Asset Management:

I do not offer financial planning services or manage assets on behalf of others. All insights and analyses are based solely on my personal investment research and decisions.

Transparency of Credentials:

I am not a certified financial advisor, and I do not possess formal financial education or certifications. My content is based on publicly available data and my personal opinions.

Use of AI:

Some content is crafted with the assistance of AI tools to streamline research and writing.